A Seed Round Led by Moniepoint Inc

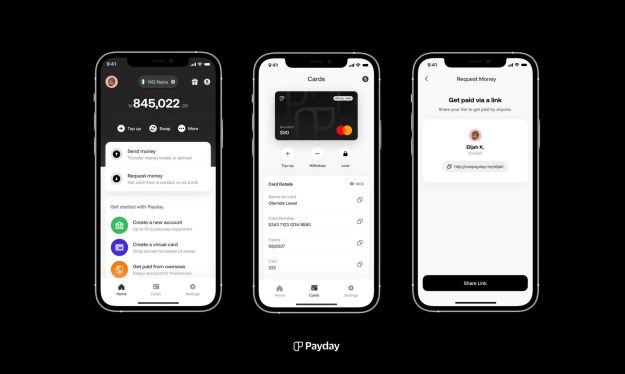

Payday, a pioneering fintech company that aims to revolutionize the way Africans send and receive money across borders, has secured $3 million in seed funding. The investment was led by Moniepoint Inc (formerly TeamApt Inc), a US-based entity that houses Moniepoint Microfinance Bank and TeamApt Nigeria. This significant funding will enable Payday to further its ‘future of work’ initiative, which focuses on providing borderless payment alternatives in major currencies.

Participation from Key Investors

The seed round saw participation from various key investors, including Techstars, Angels Touch, HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II, and other notable names. This broad range of investors demonstrates the growing interest in fintech startups that are addressing critical needs in emerging markets.

Payday’s Mission

Payday was founded by Tage Kene-Okafor with the mission to provide a seamless experience for Africans to send and receive money across borders. The company aims to break down geographical barriers, making it easier for individuals and businesses to operate globally. With this new funding, Payday will intensify its marketing efforts, expand its team, and accelerate product development.

Expanding Operations

The $3 million investment will be used to secure operational licensing in the UK and Canada while building out operations in the former. The Kigali and Vancouver-based fintech company will also focus on hiring more talent as it looks to expand from 35 to 50 employees in the coming weeks. Fresh additions have been made to its founding and executive team, which initially comprised Tage Kene-Okafor, who ran Payday all by himself for 18 months.

New Hires and Promotions

Payday has welcomed new talent to its team, including Elijah Kingson as co-founder and CPO from global fintech Revolut. Yvonne Obike, now COO and co-founder at the company, brings extensive experience with stints at Nigeria’s Bank of Industry. Sean Udeke, an ex-Goldman Sachs and Expedia product manager, has joined as head of products, where he will oversee new offerings such as loans and credit cards.

Future Plans

Payday aims to study customer and spend behaviors to offer personalized financial services, including loans. The company also plans to issue credit cards, enabling students in Nigeria to build their credit from abroad with Payday. As Tage Kene-Okafor notes, "We’re supporting the future of work by targeting remote workers and freelancers."

Conclusion

Payday’s significant funding milestone demonstrates the growing interest in fintech startups that are addressing critical needs in emerging markets. With this new investment, Payday will intensify its marketing efforts, expand its team, and accelerate product development to make borderless payments a reality for Africans.

About the Author

Tage Kene-Okafor is a reporter at TechCrunch based in Lagos, Nigeria, covering the intersection of startups and venture capital in Africa. He can be reached at tage(dot)techcrunch(@)gmail.com.