Introduction

The recent calls for early legislative elections by President Emmanuel Macron have led to a deterioration of France’s fiscal and political outlooks. This has resulted in worsening funding conditions for the government, which is reflected in the diverging yields on 10-year French government bonds from those of Germany while converging with lower-rated euro-area sovereigns such as Spain and Portugal.

Downgrade by Scope Ratings

On October 18, Scope Ratings downgraded France’s credit rating to AA- from AA due to the country’s deteriorating fiscal outlook and fragmented political environment. The downgrade was based on several factors, including:

- Recurrent revisions of fiscal targets: These changes undermine confidence in the government’s ability to comply with new EU fiscal rules.

- Budgetary slippage: Recent budgetary slippage suggests that the government is struggling to manage its finances effectively.

Challenging Political Outlook

The current political landscape in France is highly fragmented, with no coalition holding a majority in the National Assembly. This is likely to slow down budgetary consolidation, which could lead to a rise in general government debt. According to Scope Ratings’ projections, this debt will reach 119% of GDP by 2029 from 97% in 2019.

Budget Deficits and Amortizations

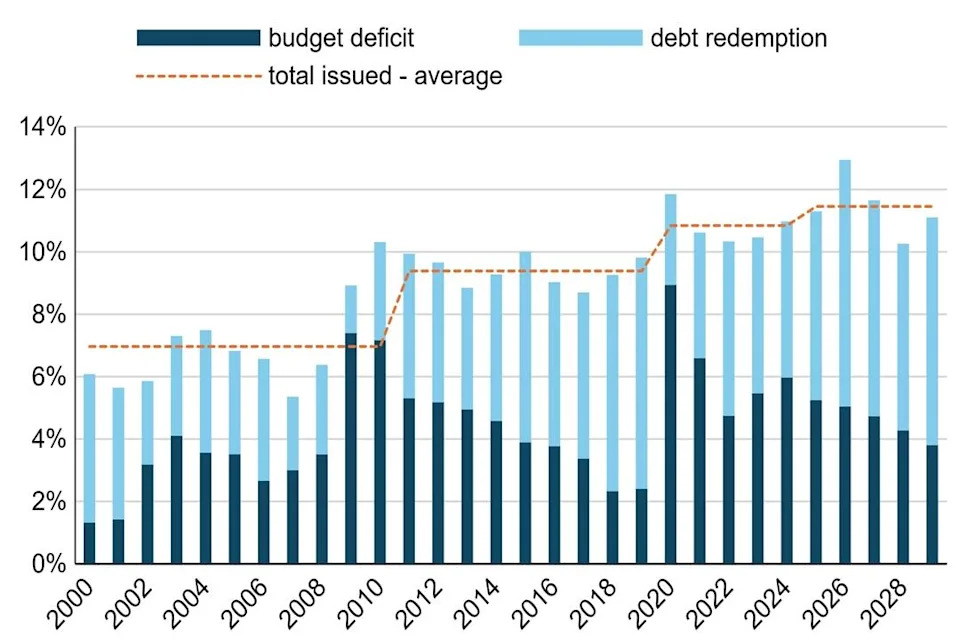

The combination of large budget deficits and higher amortizations is expected to result in the issuance of more government bonds than usual over the next few years. This is reflected in Figure 1, which shows that the total amount issued will exceed long-term averages.

Figure 1: Higher Budget Deficits, Amortizations Keep Bond Issuance Near Record Highs

| Period | Total Amount Issued (estimates) | % of GDP |

| — | — | — |

| 2000-10 | 14.3% | – |

| 2011-19 | 17.4% | – |

| 2020-24 | 21.2% | – |

| 2025-29 (estimates) | 23.8% | – |

Investor Demand Remains Strong

Despite the challenging fiscal and political environment, investor demand for French government bonds has remained strong. The bid-to-cover ratio at medium and long-term government bond auctions remained around 2.7 between June and September 2024, which is in line with its long-term average since the early 2000s (Figure 2).

Figure 2: Investor Demand Mitigates Risks Stemming from Higher Interest Rates

| Period | Cover Ratio | Average Rate |

| — | — | — |

| 2000-10 | 2.6% | 4.3% |

| 2011-19 | 2.5% | 3.8% |

| 2020-24 | 2.7% | 2.9% |

Factors Contributing to Strong Investor Demand

The strong investor demand for French government bonds can be attributed to several factors, including:

- Diversified investor base: About 55% of French debt is held by non-residents.

- Average maturity on marketable debt: Exceeds eight years.

- Debt stock fully denominated in euros: This reduces exchange-rate risk for investors.

Funding Conditions to Remain Sensitive

While funding conditions are likely to remain sensitive to near-term fiscal and political developments, Scope Ratings expects France’s 2025 funding program (estimated slightly lower at EUR 307bn compared with EUR 319bn in 2024) to continue meeting strong investor demand. This is supported by limited issuance volume expected from Germany, particularly after the collapse of its coalition government.

Global Geopolitical Outlook

The uncertain global geopolitical outlook may also contribute to strong investor appetite for French debt, given France’s safe-haven status as a core euro-area member state.

Conclusion

In conclusion, while France’s fiscal and political outlooks are challenging, Scope Ratings expects the country’s core economic strengths to offset these challenges at the AA- sovereign-rating level ahead of the next presidential election in 2027. The strong investor demand for French government bonds will likely continue to mitigate risks stemming from higher interest rates.

About the Author

Thomas Gillet is a Director in Sovereign and Public Sector ratings at Scope Ratings GmbH, and primary analyst on France’s sovereign credit rating. Brian Marly, a senior analyst at Scope, contributed to drafting this comment.

More From FX Empire

- Gold: Markets Pause Ahead of US CPI Numbers

- UK: Budget Aims for Growth but Easing of Fiscal Rules Raises Economic Risks

- Financial Technology Growth Sends Fiserv Shares Up

- Arista Networks Rising Higher

- ExlService Holdings Grows Sales, Expands AI Investments