Here is a rewritten version of the article in a neutral tone, without any additional comments or opinions:

Bank of Canada Signals More Rate Hikes to Tackle Inflation

The Bank of Canada has signaled that it will continue to raise interest rates to tackle inflation, which surged to 5.1% in January from a year earlier. The central bank’s governor, Macklem, stated that the timing and pace of further increases in the policy rate will be guided by the bank’s ongoing assessment of the economy and its commitment to achieving the two percent inflation target.

Economic Growth

The Canadian economy has been growing at a rapid pace, with gross domestic product increasing at an annual rate of 6.7% in the fourth quarter, exceeding the Bank of Canada’s expectations. Statistics Canada also reported that GDP grew in January, despite forecasters predicting it would stall or contract due to strict health measures implemented around Christmas.

Monetary Policy

The Bank of Canada has been purchasing government bonds since the pandemic to implement quantitative easing (QE). While QE is no longer being used to create new money, the central bank is still buying debt with proceeds from expiring bonds. Macklem stated that the Bank of Canada will eventually stop reinvesting its portfolio and initiate quantitative tightening (QT), but provided no specific timeline.

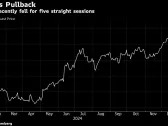

Interest Rate Hikes

The next round of policy deliberations is set for April, followed by meetings in June, July, September, October, and December. A quarter-point increase at each of these dates would leave the benchmark rate at two percent by year end. The Bank of Canada’s inflation target is two percent.

Macklem’s Comments

In a recent interview, Macklem stated that he wouldn’t actively sell the Bank of Canada’s portfolio because most of the debt on its balance sheet is of short duration, meaning holdings will naturally shrink relatively quickly once QT begins. He also called the situation in Ukraine "deeply troubling" but emphasized that higher commodity prices and potential supply chain disruptions will put upward pressure on consumer prices.

Implications

The Bank of Canada’s decision to raise interest rates may have significant implications for borrowers, particularly those with variable-rate mortgages or loans. It is essential for consumers to monitor their financial situation and adjust their spending habits accordingly.