Apple’s Challenging Start to 2025: Investors Worry About Chinese Market

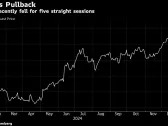

Shares Fall for Five Straight Sessions Before Monday’s Bounce

Apple Inc. shares have had a difficult start to 2025, as investors grow concerned about the company’s performance in the crucial Chinese market. The stock fell for five consecutive sessions before rebounding on Monday, marking its longest losing streak since April. This downturn has been fueled by weak iPhone sales and concerns over China’s slowing consumer spending.

Weaker iPhone Shipments and Discounts

The shares dropped as much as 1% in Tuesday trading, following a downgrade to "sell" from MoffettNathanson. Analysts cited Apple’s weakening position in Asia, along with other issues, for their decision. The company is not only losing market share among Chinese consumers but also faces the potential threat of a trade war that could exhaust its political capital and lead to adverse effects.

China’s Impact on Apple’s Growth

The Chinese market is critical for Apple, as it serves both as an end-market and the heart of its supply chain. Analysts at Bloomberg Intelligence point out that China has been plagued by a slowdown in consumer spending and increased competition from Huawei. This situation reflects negatively on the iPhone 16 cycle.

Greater China’s Importance to Apple

The region of greater China is significant for Apple, accounting for 17% of fiscal 2024 revenue, according to data compiled by Bloomberg. The US accounted for 36%. Analysts predict $21.7 billion in revenue from greater China in the first quarter. However, Jack Ablin, chief investment officer at Cresset Wealth Advisors, notes that Apple’s reliance on China is a concern due to its sizeable consumer market and manufacturing capabilities.

Tariff Risks Under President-elect Trump

The stock could be vulnerable to risks related to tariffs under President-elect Donald Trump. Analysts estimate that a worst-case scenario could add $256 of cost per iPhone. While there is optimism about Tim Cook’s ability to manage this risk, as he did during the first term, Jefferies analysts warn of the potential for significant costs.

Valuation and Growth Expectations

Apple trades at more than 32 times estimated earnings, above its long-term average and higher than the Nasdaq 100 Index. This valuation makes the stock more expensive than Microsoft Corp. and comparable to Nvidia, which are expected to deliver stronger growth in the coming year.

Tech Chart of the Day: Nvidia’s Record High

Meanwhile, tech stocks have shown resilience, with Nvidia rallying 3.4% on Monday to close at a record high of $149.43 ahead of CEO Jensen Huang’s keynote at the CES trade show in Las Vegas. The stock added more than $120 billion in market value on Monday but wavered in Tuesday trading after announcing new chips, software, and services.

Additional Tech Stories

- Nvidia showcased its products and strategy to hundreds of attendees for over 90 minutes, including tie-ups with Toyota Motor Corp. and MediaTek Inc.

- Meta Platforms Inc. elected three new directors to its board, including UFC Chief Executive Officer Dana White

- Microsoft Corp. plans to spend $3 billion to expand its cloud computing and artificial intelligence capabilities in India

- The US has blacklisted Tencent Holdings Ltd. and Contemporary Amperex Technology Co. Ltd. for alleged links to the Chinese military

- Venture capitalists invested a record $97 billion in AI startups in the US last year